SMALL AND MEDIUM ENTERPRISES

Book Keeping /Accounting / Finance / Tax words that make you uncomfortable. When you are already stretched for time, how can you possibly squeeze even more hours out of your day? Focus on your business expertise and leave the rest up to the advisors you trust! The advisors who have values, experience, knowledge, and relationships.

Here are the reasons to contact us :

You are ready to become the entrepreneur but do not know how to start

You are in business but bookkeeping is not your favorite

You need expert advice for Tax matters especially GST / HST matters

You need Payroll Services

You are ready to apply for credit but require professional assistance

AND

Because most startups fail due to money, but much more succeed because they have a solid plan for growth and an efficient method for achieving it. You need a small business accountant for your startup that will be with you throughout the business life-cycle – from hanging your shingle to incorporation to closing up shop.

Because Small business accounting is more than tax preparation and annual financial statements. If you’re looking for a right-hand adviser you can call on year round for all things related to the growth of your business,

Because the shoe box routine just isn’t working.

Because it’s time to separate the personal from the business.

Because it requires more expertise and planning than online incorporation websites can provide.

It’s the time we talk!

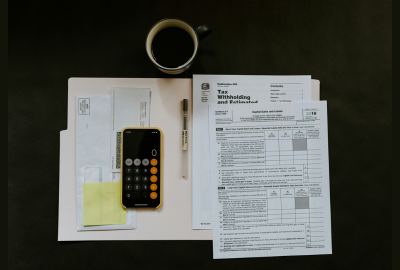

TAX ADVISORY

Our Personal and Business Tax services are designed to meet your business tax compliance and advisory needs.

Our tax professionals draw on their diverse perspectives and skills to give you a seamless service through all the challenges of planning, financial accounting, tax compliance and maintaining effective relationships with the tax authorities.

Our talented people, consistent global methodologies and unwavering commitment to quality service give you all you need to build the strong compliance and reporting foundations and sustainable tax strategies that help your business achieve its ambitions.

INCOME TAX PLANNING AND TAX RETURN PREPARATION

Our expertise in tax law, tax planning and tax preparation helps you to protect your resources and minimize your tax burden.

- On-going tax consultation service throughout the year to advise and update you on the latest in tax legislation and opportunities.

- Year-end tax planning, to ensure all benefits due are maximized prior to year-end. This service includes preparation of tax estimates early in the year so you can act upon them.

- Expert tax return preparation including Canadian returns, cross-border situations, taxation for immigrants and non-residents.

Here the reasons to contact us :

You are ready to become the entrepreneur but do not know how to register with CRA or licences requirements..

It is the time of filing tax returns and you need the expert advice

You need advice for Tax matters especially GST / HST matters

You need advice on tax implication of any financial transaction

You are new immigrant and want to know your tax benefits

AND

Because you want to reduce the tax legally

Because you want to avail all the benefits available to you as per the Tax laws

Because you don’t want tax penalties

It’s the time we talk!

FINANCIAL COUNSELLING

Financial counselling requires by anyone : a struggling or failed business, reduction in working hours, a drop in sales commission, divorce or separation, injury or illness, or simply previous poor financial decision making and bad advice coming home to roost.

It’s important to understand that you need financial counselling whenever your debt repayment schedule installments increases 50% of your net monthly income. It is given you an alarm a warning sign that you are in DEBT and need to have financial counselling to come out of this situation or your credit will start effecting. With timely counselling, a solid debt restructuring plan, plus immediate credit rebuilding, you can move on from your debt, wiser, financially solid and fortified against ever going into debt again.

Quality financial counselling can help you solve financial problems no matter how troubling your money situation might be. Financial counselling services are provided by highly qualified financial counsellors . They are experts in finding financial solutions. They will put you on a path to a solution that you can afford. Financial counsellors will:

- Do a complete review of your financial situation, looking at your income, expenses, debts and assets.

- Enroll you in a Financial Management Program, or find another solution that puts you in control of your finances.

- Teach you about rebuilding creditand managing a budget, so you can live life free of bad debt.

Here are the reasons to contact us :

You are under debt and unable to pay the installments on time

You credit rating is poor and you want to re-build it.

It’s the time we talk!

CROSS BORDER TRANSACTIONS

Looking for doing transactions in Gulf region . Establishing business in United Arab Emirates ( UAE) or Qatar ?. With representative office in Dubai- United Arab Emirates TFC has the in-depth knowledge and expertise in Business Environment of Gulf Region.

You need us if :

You intend to setup business in Gulf Region and need expert advice

You are in transaction with any of the Gulf Region and require tax assistance

You are visiting UAE and require any assistance

You require any knowledge about UAE business environment or facilities

It’s time we talk!

TAX ADVISORY:

Our Personal and Business Tax services are designed to meet your business tax compliance and advisory needs.

Our tax professionals draw on their diverse perspectives and skills to give you a seamless service through all the challenges of planning, financial accounting, tax compliance and maintaining effective relationships with the tax authorities.

Our talented people, consistent global methodologies and unwavering commitment to quality service give you all you need to build the strong compliance and reporting foundations and sustainable tax strategies that help your business achieve its ambitions.

Income Tax Planning and Tax Return Preparation

Our expertise in tax law, tax planning and tax preparation helps you to protect your resources and minimize your tax burden.

- On-going tax consultation service throughout the year to advise and update you on the latest in tax legislation and opportunities.

- Year-end tax planning, to ensure all benefits due are maximized prior to year-end. This service includes preparation of tax estimates early in the year so you can act upon them.

- Expert tax return preparation including Canadian returns, cross-border situations, taxation for immigrants and non-residents.

Here the reasons to contact us :

You are ready to become the entrepreneur but do not know how to register with CRA or licences requirements..

It is the time of filing tax returns and you need the expert advice

You need advice for Tax matters especially GST / HST matters

You need advice on tax implication of any financial transaction

You are new immigrant and want to know your tax benefits

AND

Because you want to reduce the tax legally

Because you want to avail all the benefits available to you as per the Tax laws

Because you don’t want tax penalties

It’s the time we talk!

LOAN PACKAGING

True Financial Consultants ( TCF) offers loan packaging and placement. Our services are needed because the Small Business Administration (SBA) and other government entities such as the Government Grants for new businesses that guarantee business loans require that loan requests be prepared under guidelines in order to be reviewed and approved.

TCF service includes financial education, business plan improvement, development of accurate financial projections, and preparation of loan requests for any lender in the Ontario area.

TCF helps you identify if you could qualify for financial assistance from a traditional or a non traditional lender. TCF staff has expertise in financial lending and an extensive network within the various lending sources, including the five High Risk lenders that service in Ontario.

We offer consulting services to small business owners in conjunction with writing business plans, as well projections and financial statements to help start and manage a small business.

Here are the reasons to contact us :

You are ready to apply for the credit but need expert advice before applying..

You already applied and require financial supporting documents like financial projections , budgeting , financial statements..

Your loan application has been declined by conventional Banks and you are looking for the non- conventional banks to support you

You need expert advice how to build up your credit score.

It’s the time we talk!

FINANCIAL COUNSELLING

Financial counselling requires by anyone : a struggling or failed business, reduction in working hours, a drop in sales commission, divorce or separation, injury or illness, or simply previous poor financial decision making and bad advice coming home to roost.

It’s important to understand that you need financial counselling whenever your debt repayment schedule installments increases 50% of your net monthly income. It is given you an alarm a warning sign that you are in DEBT and need to have financial counselling to come out of this situation or your credit will start effecting. With timely counselling, a solid debt restructuring plan, plus immediate credit rebuilding, you can move on from your debt, wiser, financially solid and fortified against ever going into debt again.

Quality financial counselling can help you solve financial problems no matter how troubling your money situation might be. Financial counselling services are provided by highly qualified financial counsellors . They are experts in finding financial solutions. They will put you on a path to a solution that you can afford. Financial counsellors will:

- Do a complete review of your financial situation, looking at your income, expenses, debts and assets.

- Enroll you in a Financial Management Program, or find another solution that puts you in control of your finances.

- Teach you about rebuilding creditand managing a budget, so you can live life free of bad debt.

Here are the reasons to contact us :

You are under debt and unable to pay the installments on time

You credit rating is poor and you want to re-build it.

It’s the time we talk!

Cross Border Transactions:

Looking for doing transactions in Gulf region . Establishing business in United Arab Emirates ( UAE) or Qatar ?. With representative office in Dubai- United Arab Emirates TFC has the in-depth knowledge and expertise in Business Environment of Gulf Region.

You need us if :

You intend to setup business in Gulf Region and need expert advice

You are in transaction with any of the Gulf Region and require tax assistance

You are visiting UAE and require any assistance

You require any knowledge about UAE business environment or facilities

It’s time we talk!